At Common Wealth, we are committed to providing investment options that align with our members’ values and financial goals. If you are looking for a shariah-compliant investment option, we’ve made it simple for you to integrate it into your Common Wealth plan.

The Value of a Shariah-Compliant Fund in Your Common Wealth Plan

We’ve partnered with Mackenzie Investments, a Canadian and globally recognized asset manager, to bring you a high-quality shariah-compliant investment option. Here’s what makes this fund a strong choice:

- Diversified global equity portfolio: Managed by Mackenzie’s Global Quantitative Equity Team, ensuring a strategic, well-balanced investment approach.

- Certified shariah compliance: Regularly reviewed and audited by the Islamic Finance Advisory Board.

- Strict investment screening: Stocks are selected only from the Dow Jones Islamic Market World Index, adhering to shariah financial principles.

- Transparent purification process: Provides an annual purification ratio to help you easily fulfill any necessary charitable donations.

How This Fund is Integrated into Your Common Wealth Plan

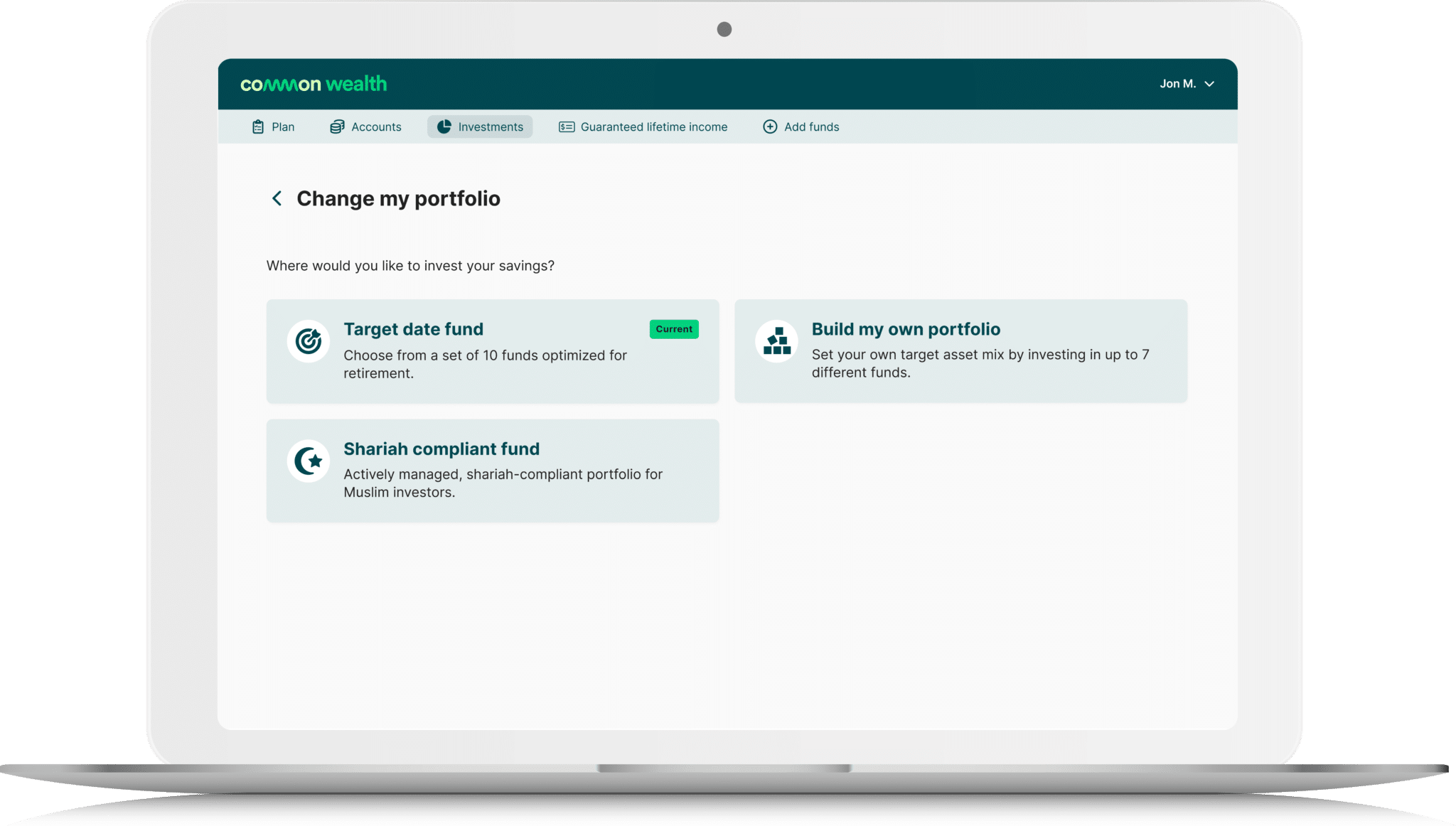

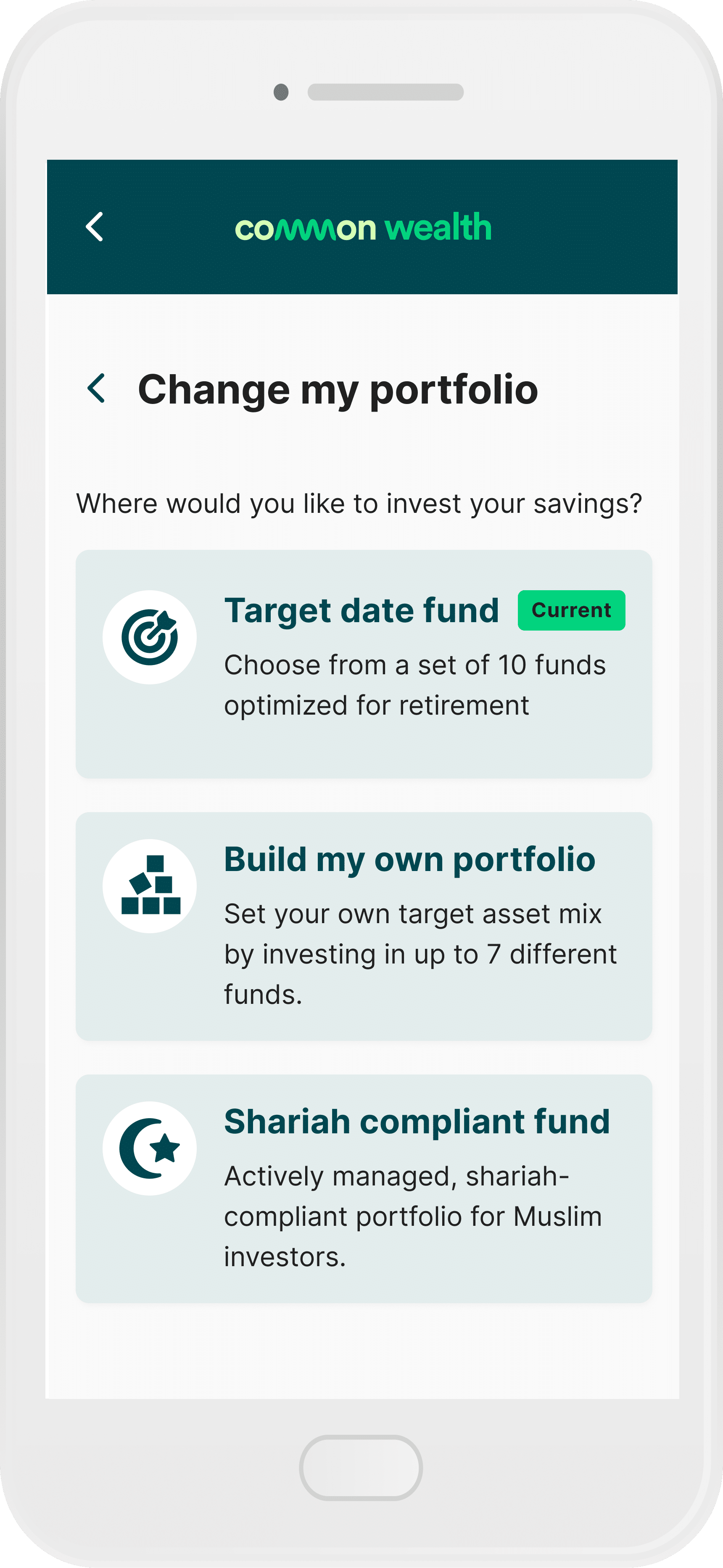

We want to make investing in a shariah-compliant fund as seamless as possible for our members. Here’s how you can access it:

- Easy selection: When choosing your investments, you’ll see the Mackenzie Shariah Global Equity Fund clearly labeled in your investment options.

- Transparent and accessible information: In your Common Wealth account, you’ll find clear explanations of the fund’s features and how it aligns with shariah principles.

- Personalized dividend purification calculation: We calculate the purification ratio for you and provide guidance on fulfilling any charitable donation requirements.

- Ongoing education and support: Webinars, videos, and articles are available to help you feel confident in your investment choices.

Understanding Shariah-Compliant Investing

Shariah-compliant investing – also known as halal investing – follows Islamic finance principles by avoiding industries and financial practices that do not comply with Islamic law, such as:

- Interest-based earnings (riba)

- Companies involved in alcohol, gambling, weapons, or pork products

- Excessive uncertainty (gharar) in financial transactions

This fund is rigorously reviewed by a board of Islamic finance scholars to ensure compliance, giving you confidence that your investment aligns with your values.

Have Questions?

If you have any questions or need guidance on selecting this fund, reach out to our support team. We’re here to support you in making the best choices for your retirement planning and saving.

With Common Wealth, you can invest for the future while staying true to your values.