Contribution Room

The RRSP deadline to contribute to your plan is coming up, and you may be wondering how much you can contribute to your Common Wealth plan. General contribution limits for RRSPs, TFSAs, and DPSPs are set by the government and can be found here.

If your plan includes a DPSP, your employer’s DPSP contributions will reduce your RRSP contribution limit next year. For example, if your employer contributes $1,000 to your DPSP in 2024, your personal RRSP contribution room will decrease by $1,000 in 2025.

Please ensure your RRSP contributions are completed through your Common Wealth plan by Sunday, March 2, 2025. This allows our team to process everything in time to meet the CRA deadline on Monday, March 3, 2025.

Contact the CRA

You can get your contribution room online through the CRA’s My Account service. If you have not yet created an account, you can contact the Canada Revenue Agency at 1-800-267-6999.

Paper Notice of Assessment

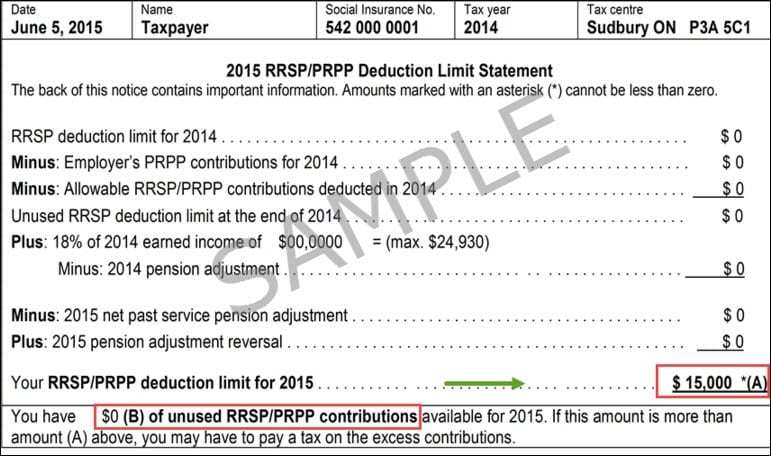

You can also check your last notice of assessment or reassessment notice from the CRA to find your RRSP deduction limit.

Don’t forget the TFSA

Your Common Wealth plan also comes with a TFSA. That means you can contribute another $7,000 to your retirement plan. Many people don’t think to use TFSAs for retirement, but every dollar of retirement income you withdraw from a TFSA is 100% tax-free. The CRA has set the 2025 TFSA contribution limit at $7,000, unchanged from 2024.

Tax Refunds

If it looks like you might be getting a tax refund in the spring, you can consider putting it to work in your Common Wealth plan.

Need Help?

Have questions about contributing to your Common Wealth plan? Contact one of our retirement specialists.